Frequently Asked Question

Actuarial science is a field that uses mathematics and statistics to

measure, manage, and mitigate financial risk and uncertainty.

Actuaries typically work in insurance, pensions, and finance, helping

companies predict and plan for potential future events.

Click Here for the Reel👇

What is actuarial science? in 60 seconds

Click Here for the Reel👇

What is actuarial science? in 60 seconds

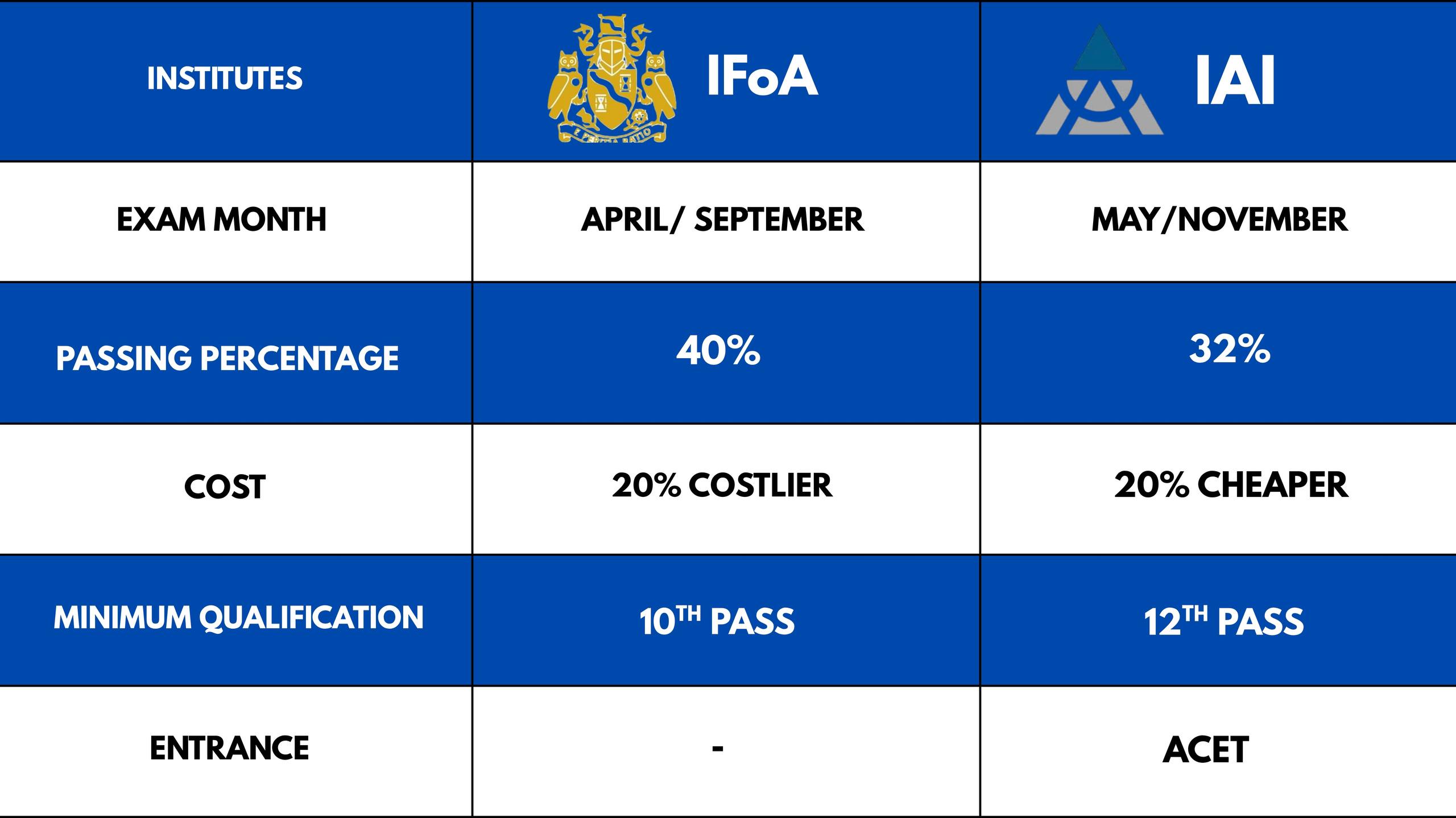

a. Institute and Faculty of Actuaries (IFoA):

i.

Eligibility: Start

right after 10th standard.

ii.

Requirement: Completion of a basic math course taught by “The Actuarial Academy” (For Students in 10/11/12th Std)

b.

Institute of Actuaries of India (IAI):

i.

Eligibility: Must

be 12th pass

ii.

Requirement: Clear

the ACET examination

c. Qualification Requirements:

i.

Complete all 13 papers.

ii.

Accumulate 3 years of work experience to become a qualified actuary.

Like every professional degree actuarial science also requires the students to study rigorously for the actuarial subjects. It is definitely very rewarding for those who enjoy problem-solving and analytical thinking.

Check out our reel to know 👇

Yes, it is necessary to pursue a graduation program alongside

actuarial science.

A strong background in mathematics, particularly in algebra and

statistics, is essential. A benchmark for those who want to start

their actuarial journey can be around

80+ marks in mathematics in either your 10th or 12th

grade.

It typically takes 4–6 years to become a fully qualified actuary,

depending on the individual’s pace in passing exams and gaining

relevant work experience. Many actuaries work full-time while

completing their exams.

A student should consider a graduation course that requires minimal

college attendance and is similar to an actuarial science course, such

as a Bachelor of Financial Markets (BFM) or a Bachelor of Commerce

(BCom). Additionally, a student with a science background might opt

for a Bachelor of Science in Statistics (BSc Stats).

Check out our Reel for a brief overview 👇

Which graduation degree to choose?

Check out our Reel for a brief overview 👇

Which graduation degree to choose?

Many students secure entry-level actuarial positions after passing 2–3

exams. Employers often value exam progress and relevant internships

when hiring.

Actuaries work in various sectors including insurance companies (life,

health, property, and general), pension funds, consulting firms,

government agencies, and investment firms. They may also work in

non-traditional fields like financial investment and risk management.

To become an actuary, you’ll need a blend of strong mathematical and

statistical skills, analytical thinking, problem-solving abilities,

and proficiency in programming languages like R. Good communication

skills are also essential for explaining complex concepts to

non-experts. If you’re concerned about acquiring these skills, don’t

worry—

The Actuarial Academy is here to help you develop all

the necessary skills required to become an Actuary!!!

Anyone with a strong interest in mathematics, statistics, and finance

can pursue actuarial science. It is particularly suited for those who

enjoy solving mathematical questions.

Actuarial students often enjoy a good work-life balance, although they

do need to prepare for actuarial exams while working. Many employers

support their employees by offering study leave and financial

assistance for exam fees, making it easier to manage both work and

study commitments.

If you stop pursuing actuarial science after completing a few exams,

you still possess valuable mathematical and analytical skills that are

transferable to other careers in finance, data analysis, risk

management, and consulting. Many of these skills are in high demand

across various industries.

In order to know better, book your career counselling session now:

Contact Us

Contact Us